ANTA Buys $1.8 Billion Stake in Puma to Become Largest Shareholder

PublishedQuick Facts

- ANTA has acquired a 29.06% stake in Puma, making them the largest shareholder

- The brand purchased the stake from the Pinault family for $1.8 billion

- ANTA believes Puma has potential in the Chinese market

- Puma has been in financial trouble, projected to operate at a loss in 2025, and recently took a 500 million Euro bridge loan

- ANTA is not looking for a full takeover, but will seek seats on the board

Puma’s consistent financial woes resulted in rumors that multiple companies were in talks to buy the German sportswear brand. No, rival adidas did not cross the Aurach River in Herzogenaurach to buy Puma; the Chinese sportswear brand ANTA has reportedly bought a $1.8 billion stake to acquire a 29.06% ownership stake in the label, making it the largest shareholder.

In a quote to Reuters, who first reported the story, Wei Lin, ANTA global vice-president for sustainability and investor relations, stated, "Puma has more potential in the Chinese market, where they are underrepresented with only 7% of their global revenues. We have a lot of insight on how to make Puma more successful in China.”

After news of the sale went public, Puma shares jumped about 17%, but over the last year, the stock has been down nearly 25%, and over the last five years, it's down nearly 75%. Last month, the brand was reported to have taken a 500 million Euro bridge loan. In September, initial rumors of a potential sale to adidas or another brand began to emerge. Puma reported they would operate at a loss in FY2025 in its Q2 2025 financial results.

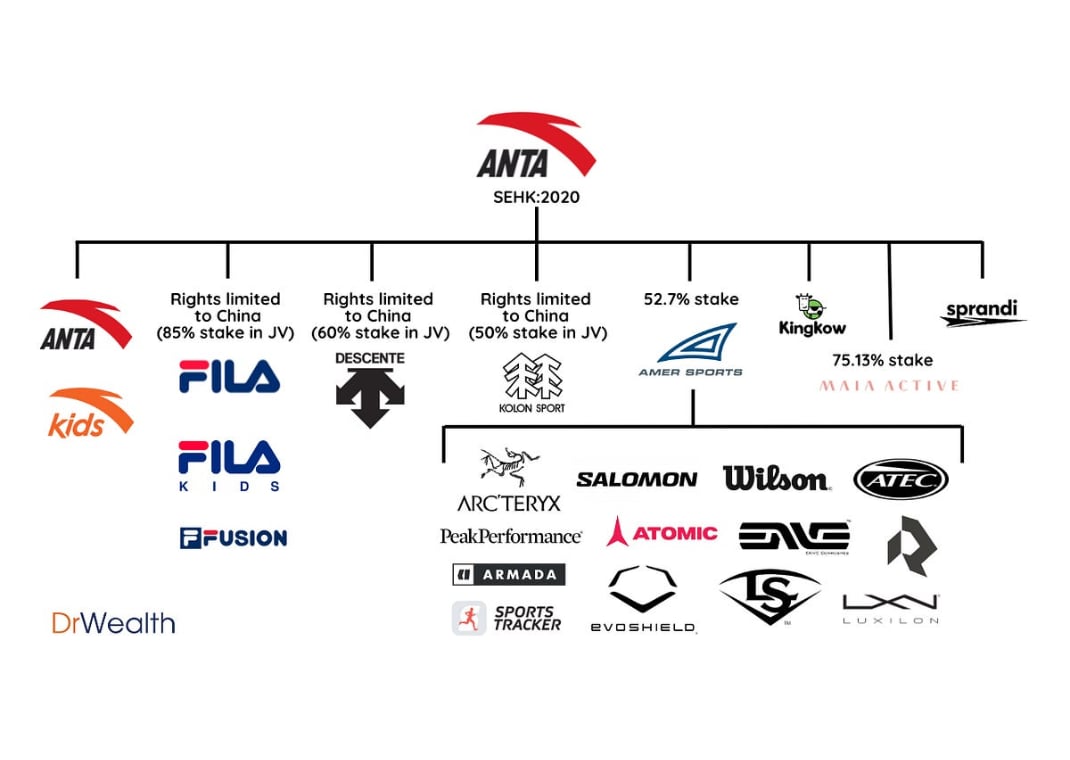

Image via Growth Dragon Substack

With this purchase, ANTA Sports Products expands its sportswear portfolio, including a 52.7% stake in Amer Sports, the parent company of brands like Arc’teryx, Salomon, and Wilson. ANTA also owns the rights to Fila in China.

"ANTA has already shown with other brands that it can successfully support them (e.g. Amer Sports)," said Christian Reindl, portfolio manager at Union Investment, a Puma shareholder. "Operationally, however, Puma remains a restructuring case for the time being."

ANTA has stated it will not seek a full takeover of the company, but it will vie for seats on Puma’s board once the deal is finalized. With ANTA helping brands like Salomon become a major player in the footwear space, could this deal bring Puma back to the forefront for sneakerheads? Only time will tell. ANTA’s track record of turning around Western brands in the Chinese market bodes well for Puma’s financial health, though again, it will take some time to get the German label back in the black.

Sneakerhead from South Florida who turned his passion into a career. When not writing for Sole Retriever, I enjoy attending concerts, catching the latest movies, and trying new food. Email: nick@soleretriever.com